Creating and maintaining an effective budget is crucial for financial health and stability. A well-structured budget helps you manage your money more efficiently, save for future goals, and avoid debt. Here’s a comprehensive guide to help you master the art of budgeting.

Calculate Your Net Income

Net income refers to your take-home pay after deductions for taxes, Social Security, health insurance, retirement contributions, and other programs. Understanding your net income is essential as it provides a clear picture of the money you have available to spend. To calculate it, look at your pay stubs or bank statements to see what you bring home after all deductions. This figure is the foundation of your budget, preventing overspending and ensuring that you live within your means.

Track Your Spending

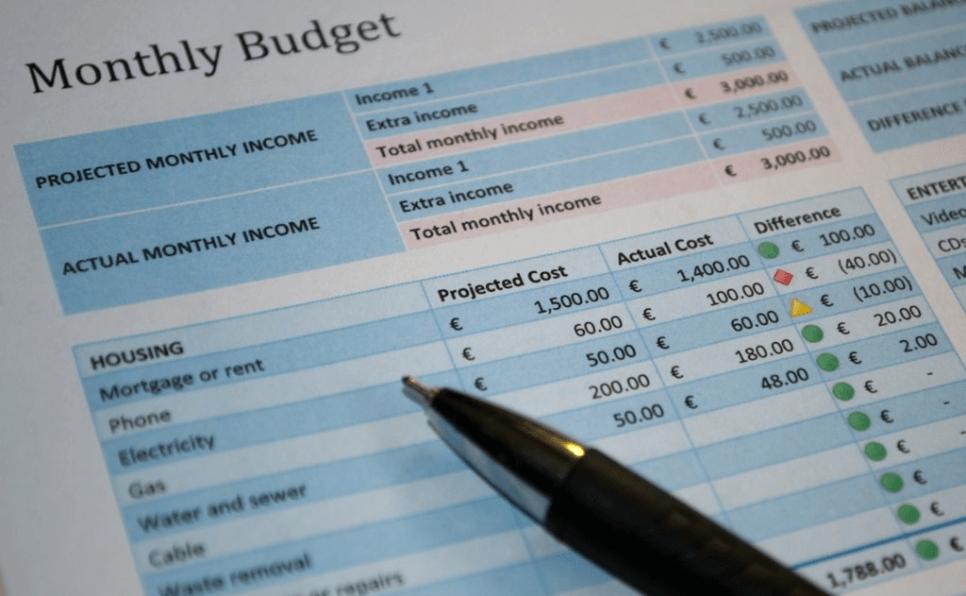

Tracking your spending is the foundation of a successful budget. By categorizing your expenses, you can see exactly where your money is going. There are various methods to track spending, such as using a notebook, a spreadsheet, or budgeting apps. Record both fixed expenses (e.g., rent, utilities, loan payments) and variable expenses (e.g., dining out, entertainment, groceries). This comprehensive overview helps identify areas where you could cut back and save more.

- Fixed Expenses: These are regular, recurring costs that are relatively constant each month. Examples include mortgage or rent payments, car payments, insurance premiums, and utility bills.

- Variable Expenses: These costs can fluctuate from month to month. Examples include groceries, gas, entertainment, dining out, and personal care items.

Set Realistic Goals

Setting both short- and long-term financial goals is a powerful motivator and a key aspect of effective budgeting. Short-term goals might include saving for a vacation, creating an emergency fund, or paying off a small debt. Long-term goals could involve saving for retirement, a child’s education, or a down payment on a house. Clearly defined goals guide your budget planning and help prioritize your spending and savings decisions.

- Short-term goals: Achievable within a year or less. Examples include buying a new gadget, planning a vacation, or paying off credit card debt.

- Long-term goals: Require several years to achieve. Examples include purchasing a home, saving for retirement, or building a college fund.

Make a Plan

Once you have tracked your spending and set your goals, it’s time to make a plan. This involves comparing your actual spending with your desired spending to see where adjustments are needed. Establish specific spending limits and distinguish between needs (essential expenses) and wants (non-essential expenses). This helps create a budget that aligns your expenses with your financial priorities.

- Needs: Essential for survival and daily living. Examples include housing, utilities, groceries, transportation, and healthcare.

- Wants: Non-essential but enhance your quality of life. Examples include dining out, entertainment, vacations, and luxury items.

Apply the 50/30/20 Rule

The 50/30/20 rule is a simple yet effective budgeting framework. It divides your income into three categories:

- 50% for Needs: Essential expenses like housing, utilities, groceries, and transportation.

- 30% for Wants: Non-essential expenses such as dining out, entertainment, and hobbies.

- 20% for Savings or Debt Repayment: Savings for future goals or paying off existing debts.

This rule simplifies budget tracking by providing clear guidelines on how much to allocate to each category. Adjust these percentages based on your personal circumstances and financial goals.

Adjust Your Spending

To stay within your budget constraints, prioritize cutting expenses classified as ‘wants’. Look for ways to reduce spending on non-essential items without sacrificing your quality of life. Additionally, consider making adjustments to your fixed expenses, such as renegotiating bills, refinancing loans, or finding more affordable alternatives. Incremental changes, like cooking at home more often or cancelling unused subscriptions, can collectively lead to significant savings.

Review Your Budget Regularly

A budget is not a static document; it should evolve with your changing financial circumstances and goals. Regular reviews of your budget are necessary to ensure it remains effective. Schedule monthly or quarterly check-ins to assess your progress, adjust your budget based on income changes, shifting priorities, or unexpected expenses. This flexibility allows you to stay on track and achieve your financial objectives.

Practical Tips for Successful Budgeting

- Use Budgeting Tools: Utilize budgeting apps and software to streamline the process. Tools like Mint, YNAB (You Need a Budget), and PocketGuard can help you track spending, set goals, and stay organized.

- Automate Savings: Set up automatic transfers to your savings account to ensure consistent savings. This reduces the temptation to spend money that’s meant for savings.

- Create an Emergency Fund: Aim to save at least three to six months’ worth of living expenses to cover unexpected costs like medical bills, car repairs, or job loss.

- Prioritize Debt Repayment: Focus on paying off high-interest debts first to reduce the overall interest paid and free up more money for savings and other goals.

- Seek Professional Advice: If you’re struggling with budgeting or have complex financial situations, consider consulting a financial advisor for personalized guidance.

Effective budgeting requires careful planning, consistent tracking, and regular adjustments. By calculating your net income, tracking your spending, setting realistic goals, making a plan, applying the 50/30/20 rule, adjusting your spending, and reviewing your budget regularly, you can take control of your finances and work towards a secure financial future. Start today and see the difference a well-managed budget can make in your life.