Saving money is not just a good financial habit; it’s a cornerstone of financial stability and future planning. A well-structured savings plan acts as a roadmap, guiding you towards achieving short-term needs like emergency funds and long-term goals such as retirement or buying a home.

Importance of a Savings Plan

A savings plan provides a safety net during unexpected financial challenges and empowers you to take advantage of opportunities that require financial readiness. Beyond financial security, it reduces stress, allowing you to focus on personal and professional growth without worrying about money.

Benefits of Savings

- Financial Security: Having savings cushions you against unexpected expenses like medical bills or car repairs, reducing the need to rely on credit cards or loans.

- Peace of Mind: Knowing you have a financial buffer brings peace of mind, allowing you to sleep better at night and handle financial setbacks confidently.

- Opportunity: Savings provide the capital needed for investments, whether it’s starting a business, funding education, or seizing investment opportunities that can grow your wealth over time.

Tracking Finances

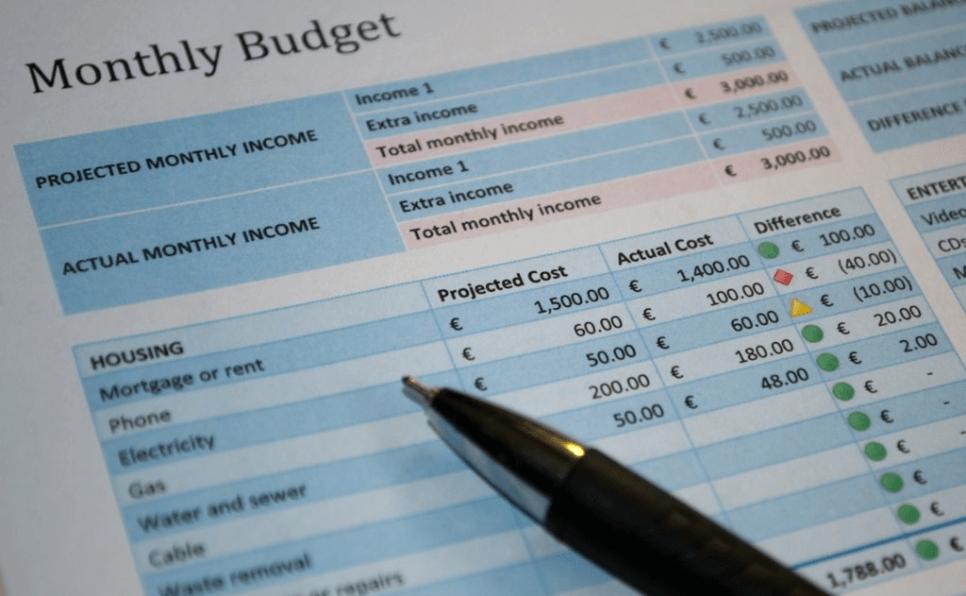

Tracking your finances is the foundation of effective savings planning:

- Income and Expenses: Start by understanding your monthly income from all sources. Track your expenses meticulously, categorizing them into fixed (rent, utilities) and variable (groceries, entertainment) expenses.

- Budgeting Tools: Use budgeting apps like Mint, Personal Capital, or You Need A Budget (YNAB) to automate this process. These tools categorize your spending, highlight trends, and provide insights into where your money goes each month.

Setting Up Savings

- Choosing Accounts: Select savings accounts with competitive interest rates. Consider high-yield savings accounts or online savings accounts that typically offer higher interest rates than traditional savings accounts.

- Automatic Transfers: Automate your savings by setting up recurring transfers from your checking account to your savings account. This ensures that savings are prioritized and consistent, without relying on manual deposits.

Avoiding Impulse Spending

- Setting Goals: Define specific savings goals, both short-term (e.g., vacation fund) and long-term (e.g., retirement savings). Write down your goals and revisit them regularly to stay motivated.

- Budgeting Techniques: Implement budgeting strategies such as the envelope system, where you allocate funds for different categories (groceries, entertainment) and stick to those limits. Zero-based budgeting ensures every dollar has a purpose, with savings allocated first before spending on discretionary items.

Types of Savings Accounts

Understanding different savings vehicles helps optimize your savings strategy:

- Cash Management Accounts: Offer high interest rates and check-writing privileges, making them ideal for day-to-day transactions while earning interest on your balance.

- High-Yield Savings Accounts: Provide higher interest rates than traditional savings accounts, often with no minimum balance requirements. They’re suitable for emergency funds or short-term savings goals.

- Certificates of Deposit (CDs) and Money Market Accounts: CDs lock in your money for a fixed period at a higher interest rate than regular savings accounts. Money market accounts combine the benefits of savings and checking accounts, offering higher interest rates with limited check-writing capabilities.

Maximizing Savings

- Compounding Interest: Start saving early to benefit from compounding interest, where your earnings generate more earnings over time. Regular contributions and reinvestment of interest can significantly boost your savings over the long term.

- Account Comparison: Compare savings accounts based on interest rates, fees, and accessibility. Some accounts may offer higher rates but require higher minimum balances or have withdrawal restrictions. Choose accounts that align with your savings goals and liquidity needs.

Enhancing Your Plan Beyond Basic Savings

- Emergency Fund: Once you’ve established basic savings, prioritize building an emergency fund. Aim to save enough to cover 3-6 months’ worth of living expenses. This fund acts as a financial cushion during job loss, medical emergencies, or unexpected repairs.

- Investing for Retirement: Beyond savings accounts, consider long-term investments like Individual Retirement Accounts (IRAs) or employer-sponsored retirement plans (e.g., 401(k)). These investments offer tax advantages and compound growth potential, helping you build wealth for retirement.

Building and maintaining an effective savings plan requires discipline, patience, and ongoing commitment. By setting clear goals, tracking your finances, and leveraging the right savings tools, you can achieve financial security and work towards your dreams with confidence.

Start today by implementing the steps outlined in this blog post. Whether you’re saving for short-term needs or planning for a comfortable retirement, a well-executed savings plan will pave the way to financial freedom and peace of mind.